Supreme Court’s interim order in Dolma Impact Fund case casts doubt on Nepal’s tax exemption agreements with 11 countries and international bodies

KATHMANDU: The interim order issued by the Supreme Court regarding the government’s decision to grant tax exemption to Dolma Impact Fund has placed Nepal’s Double Taxation Avoidance Agreements (DTAA) with 11 countries in jeopardy.

On February 11, the Supreme Court issued an interim order stating that since the DTAA between Nepal and Mauritius had not been ratified by Parliament, the government’s decision to grant tax exemption to Dolma Impact Fund based on that agreement was not legally valid and should not be implemented. Nepal and Mauritius had signed this agreement on August 3, 1999.

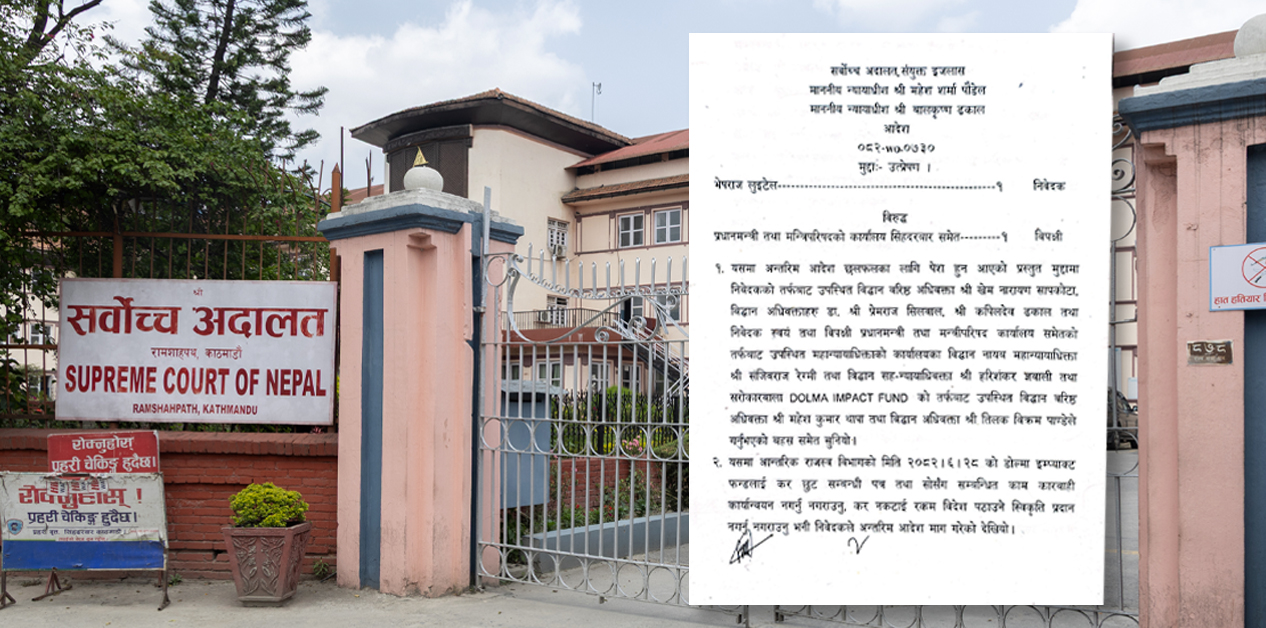

“In the absence of ratification, accession, approval, or endorsement by Parliament of the Double Taxation Avoidance Agreement between Nepal and Mauritius, if there is a conflict between treaty provisions and national law, the treaty provisions shall not prevail; rather, national law shall apply. Therefore, Dolma Impact Fund must pay taxes in accordance with prevailing law,” states the order issued by the joint bench of Justices Mohan Sharma Paudel and Bal Krishna Dhakal. Earlier, on January 8, a single bench of Justice Mohan Sharma Paudel had issued a short-term interim order to halt implementation of the tax exemption decision. Chartered Accountant Bhesh Raj Luintel had filed a writ petition at the Supreme Court seeking to prevent implementation of the decision granting tax exemption to Dolma Impact Fund.

The government, however, has treated the DTAA as having treaty status.

Dolma Impact Fund brought approximately RS 15 billion in investment through a “shell company” in Mauritius, which is considered a tax haven country. In Nepal, Dolma has invested in Sastodeal, Foodmandu, CloudFactory Holdings, F1Soft (Fonepay), Upaya City Cargo, WorldLink, Century Spices, Setikhola Hydropower, Shwet-Ganga Hydropower, Makar Jitumaya Suri Hydropower, Solar Farm, National Path Labs, Nidan Hospital, Chiryau Hospital, and Dos Pharmaceuticals.

Among these, Dolma had sought to sell shares of Makar Jitumaya Suri Hydropower. The hydropower shares were purchased for RS 260 million, and their sale would generate approximately RS 1.18 billion in profit. According to the Income Tax Act, the transaction would incur about RS 294.5 million in tax. In addition, the government could claim income tax on profits earned from Dolma’s other investments under the Income Tax Act.

The Nepal-Mauritius DTAA includes provisions exempting Dolma from tax on gains from share sales and investments. Based on this agreement, on 14 October, 2025, the Inland Revenue Department decided to grant capital gains tax exemption to Dolma. However, before this decision was made public, on 29 October 2025, the Council of Ministers revoked the DTAA with Mauritius. Subsequently, on 10 December 2025, the Department informed Mauritius of the termination. “The Government of Nepal has taken this strategic decision to align its international tax structure with significant changes in both domestic law and the global tax environment,” stated the press release issued by the Department on the same day.

Nepal has signed DTAA with 11 countries: India, Norway, Thailand, Qatar, Mauritius, Korea, Austria, China, Sri Lanka, Pakistan, and Bangladesh. However, none of these agreements have been ratified by Parliament. Citing provisions of the Treaty Act, the Supreme Court stated that such agreements must be ratified by Parliament to acquire legal status.

Section 9(1) of the Treaty Act, 2047 bs (1990) states: “If any treaty to which Nepal or the Government of Nepal is a party, having been ratified, acceded to, approved, or endorsed by the Legislature-Parliament, conflicts with prevailing law, then for the purposes of that treaty, the conflicting provisions of prevailing law shall be void to the extent of the conflict, and the treaty provisions shall apply as Nepal law.”

Nepal has signed DTAA with 11 countries: India, Norway, Thailand, Qatar, Mauritius, Korea, Austria, China, Sri Lanka, Pakistan, and Bangladesh. However, none of these agreements have been ratified by Parliament. Citing provisions of the Treaty Act, the Supreme Court stated that such agreements must be ratified by Parliament to acquire legal status.

Following the Supreme Court’s order, the decision to grant tax exemption to Dolma has been suspended for the time being. However, this is likely to affect companies and citizens from other countries with which Nepal has signed Double Taxation Avoidance Agreements, particularly concerning repatriation of profits from investments made in Nepal.

The Income Tax Act, 2058 BS (2002) grants the Inland Revenue Department the authority to decide on tax exemptions. However, department officials indicate that following the Supreme Court’s interim order disallowing tax exemption to Dolma, similar decisions may need to be made in the case of other companies. Before the final verdict is issued, if any foreign-invested company sells shares or attempts to repatriate profits, it appears they may not be able to avail benefits under Double Taxation Avoidance Agreements.

After the Supreme Court’s order, all investors who entered Nepal under the understanding of no double taxation must now pay taxes as determined by Nepal’s domestic law under Section 73(5) of the Income Tax Act. Subsection (5) specifies entities that are not eligible for tax exemption or reduced tax benefits where Subsection (4) applies.

Subsection (4) states: “This subsection shall apply where an international agreement provides that Nepal shall grant exemption or apply a reduced rate of tax on income or payments.” Clarifying further, Subsection (5)(a) and (b) state: “Such benefits shall not apply to entities that are deemed residents of the other contracting state under the agreement, but where 50 percent or more of the underlying ownership is held by natural persons or entities that are not residents of either the other contracting state or Nepal for the purposes of that agreement.”

According to this legal provision, for a Mauritius-based company to receive tax exemption in Nepal, at least 50 percent of the investment must originate from Mauritius itself. In Dolma Management, which maintains an office in Mauritius, only 0.75 percent of the investment is from Mauritius. The remaining 99.25 percent of the investment was routed from various countries into Mauritius and then brought into Nepal through Dolma Management. The Supreme Court stated that since the required 50 percent investment threshold was not met, Dolma must pay tax in accordance with Section 73(5) of the Income Tax Act.

Luintel, who filed the writ petition at the Supreme Court against the government’s decision, says: “The essence of the interim order is that if tax exemptions are to be granted specifically on the basis of an agreement, that agreement must have been ratified by Parliament. An agreement made with any country is not superior to a law enacted by a sovereign Parliament.”

Pull one thread, and a landslide follows

According to data from the Department of Industry up to mid-June 2025, the largest share of Nepal’s total foreign investment – 44.77 percent – comes from China. India is second with 19.55 percent. Similarly, Korea accounts for 4.61 percent, Mauritius 0.62 percent, Bangladesh 0.45 percent, Norway 0.21 percent, and Sri Lanka 0.13 percent. Nepal has signed Double Taxation Avoidance Agreements with all of these countries.

As per Department of Industry data up to mid-June 2025, Chinese investment in Nepal amounts to Rs 255.48 billion. Large industries such as Hongshi and Huaxin Cement have Chinese investment. Himalayan Airlines has investment from Tibet Airlines. Additionally, Chinese investment is present in hydropower projects, hotels, and restaurants.

Major industries in Nepal such as Unilever Nepal Limited, Dabur Nepal, Surya Nepal, Berger Paints, Pepsi, Asian Paints, and Johnson & Nicholson have Indian investors. According to the Department of Industry, Indian investment exceeds Rs 111.36 billion.

If the Supreme Court’s order, which has refused to recognize unratified Double Taxation Avoidance Agreements as law, is implemented, it may affect not only foreign investors in Nepal but also development partners and foreign missions, including United Nations agencies.

After China and India, Hong Kong, Korea, the United States, the United Kingdom, and Singapore are among the leading foreign investors in Nepal. Korean investors have invested in the 216-megawatt Upper Trishuli-1 Hydropower Project. Similarly, a Samsung assembly plant is operating in Nepal. The United States has invested in information technology, energy, agriculture, and tourism sectors in Nepal. According to Department of Industry data up to mid-June 2025, total foreign direct investment in Nepal stands at Rs 569.54 billion. Among the countries investing in Nepal, 11 have Double Taxation Avoidance Agreements with Nepal.

If the Supreme Court’s order, which has refused to recognize unratified Double Taxation Avoidance Agreements as law, is implemented, it may affect not only foreign investors in Nepal but also development partners and foreign missions, including United Nations agencies. For example, Nepal has agreements granting tax exemptions to multilateral institutions such as the World Bank and the Asian Development Bank. These institutions submit purchase bills to the Inland Revenue Office and claim refunds of the taxes they have paid.

“The court’s order has raised questions about the implementation of Double Taxation Avoidance Agreements. The practical situation is different. If the final verdict reiterates what has been stated in the interim order, the entire economic system could face problems,” said a senior official of the Inland Revenue Department on condition of anonymity.

Officials at the Ministry of Finance, however, state that they have not yet officially received the court’s order in the Dolma case. Joint Secretary and spokesperson of the Ministry of Finance, Tanka Prasad Pandey, says, “We have not officially received the court’s order. Once we receive it, we will discuss it and form an official position.”

Nepal has been implementing Double Taxation Avoidance Agreements for 30 years. During this period, tax exemptions and other facilities have been granted based on these agreements. Now, if the agreements are deemed invalid on the grounds that they were not ratified by Parliament, and if it is claimed that the state suffered losses as a result, the question arises: why should investors bear the consequences?

Ministry of Finance at Singha Durbar. Photo: Bikram Rai

“Investors make investments taking into account the provisions of those agreements. If those protections and facilities are withdrawn midway, who will compensate investors for the impact?” asks senior chartered accountant Shesh Mani Dahal. “A writ petition concerning one company has created a situation where treaties affecting hundreds of thousands of investors from 11 countries could be suspended. This must be taken very seriously.”

The government has introduced various plans to attract foreign investment to Nepal, including amending laws and organizing investment summits. However, Dahal says that the sudden ineffectiveness of Double Taxation Avoidance Agreements that have been in implementation for a long time could discourage foreign investment. “A predictable tax system, legal stability, and policy continuity are the foundations of investor confidence. If commitments made under three-decade-old treaties can be overturned by an interim court order, how can international investors be reassured?” he asks. Officials at the Inland Revenue Department warn that if agreements are not implemented simply because they were not ratified by Parliament, the entire economic system could be disrupted.

If the government wishes to overturn the Supreme Court’s interim order, the current government – formed after the dissolution of Parliament – has the option to file a petition for review (vacate) before the Court. The Parliament formed after the elections could ratify the agreements in accordance with the provisions of the Treaty Act and thereby implement the Supreme Court’s interim order. However, much will also depend on how the Supreme Court interprets the implementation of the agreements in its final verdict.