KATHMANDU: Finance Minister Rameshore Prasad Khanal has said that it is the shared responsibility of all stakeholders and authorities to work toward removing Nepal from the Financial Action Task Force (FATF) Gray List related to money laundering issues.

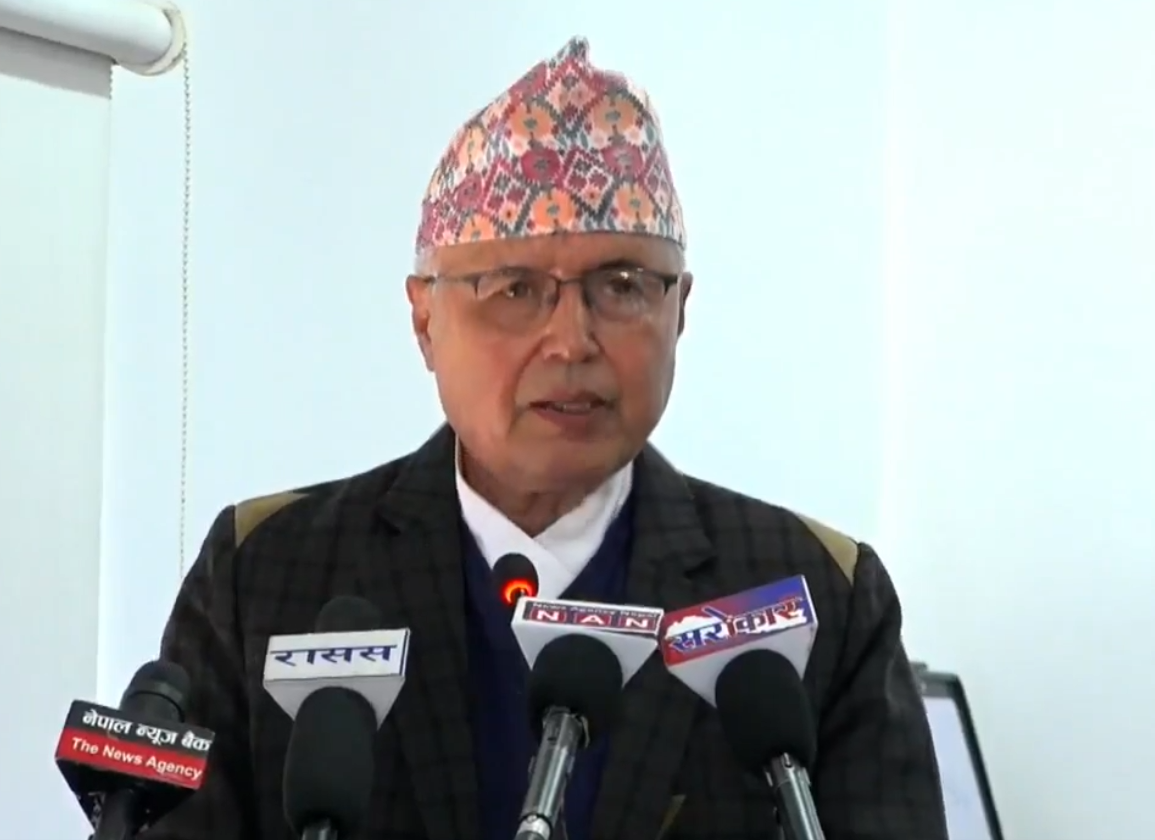

Speaking at a program organized to mark the National Anti- Money Laundering Day – 2082 BS, themed “Money Laundering Prevention: Transparency and Fiscal Discipline,” the minister stressed the need to create a solid foundation for Nepal’s removal from the Gray List within a year by completing all required reform measures.

He said that the economic reform initiatives undertaken by the government are not driven by pressure or compulsion from the international community. Rather, the efforts aim to build corruption-free institutions, promote transparency and good governance, and strengthen the national economy.

According to the minister, initiatives to prevent money laundering do not impose additional economic burdens or unnecessary costs on the country. He argued that the lower-than-expected inflow of foreign investment is due to weak confidence in Nepal’s financial system, underscoring the need to create an investment-friendly environment through reforms.

Expressing hope that the reform efforts would be completed by the end of 2026, the minister also called for greater effectiveness in investigation, prosecution, and action in money laundering cases. He stressed that cases should be prepared with strong evidence and provisions for the prompt seizure of property.

The minister also raised concerns about transparency issues not only in the financial market but also in the capital market. He informed that a provision mandating the use of the banking system for corporate transactions exceeding Rs 500,000 thereby putting a ceiling on the cash transactions has been in effect since January 15.

However, he clarified that despite concerns raised by the private sector, the ceiling on cash transactions would not be increased.

Also speaking at the program, Minister for Law, Justice and Parliamentary Affairs Anil Kumar Sinha echoed the need to address global legal, policy, and institutional challenges to ensure Nepal’s financial integrity and good governance.

He said the present situation is not merely a challenge but also an opportunity for self-reflection and further reform. An action plan has been formulated to remove the country from the Gray List within the next year, he added, calling for its effective implementation through collective efforts from all sectors.

Attorney General Sabita Bhandari reminded that Nepal has made a clear policy commitment at the international level to prevent money laundering and shared a special attention has been paid for formulation and implementation of relevant laws by according to high priority to this issue.

Speaking in the program, Attorney General Bhandari emphasized effective implementation of risk-based monitoring and regulation system based as per the FATF standards.

According to her, traditional investigation was not adequate to combat money laundering. Thus, she pointed out the need to make the investigation and prosecution process more effective, evidence-based and result-oriented.

The Attorney General informed that her office was undertaking needful actions as stipulated to be carried out by the Office of Attorney General to remove Nepal from the ‘grey list’.

Likewise, Nepal Rastra Bank (NRB)’s Deputy Governor Bom Bahadur Mishra cautioned that the international financial institutions could tighten their transactions with Nepal while Nepal is in the ‘grey list’.

He worried that this would not only spur serious social and economic problems within the country but also could pose a challenge at the international level including restrictions on travel for the Nepalis citizens and increase the cost of remittances and other international transactions.

He opined that the international community would understand Nepal being in the grey list as its weakness in controlling financial crimes. Hence, he called for effective reform measures.

Likewise, Gajendra Kumar Thakur, Director-General of the Department of Money Laundering Investigation, argued that elimination of money laundering is not responsibility of a single agency. Hence, he underlined the importance of collective efforts among all concerned agencies to alleviate it.

He informed that more than 50 governmental agencies and over 80,000 indicator organizations are involved in this sector.

Thakur indicated the potential risk of terrorist activities and illegal transactions that could account for three to 5 per cent of the country’s gross domestic production.

Stating that Nepal’s economy is still cash-based, he mentioned that the share of information economy is huge. According to him, modern systems that are in place are far from effectively regulation and shed light on the lack of skilled human resources and technology facing the country.

Although legislations are in place, their implementation is lax, he stated.

Stating that risk of money laundering in higher in the real estate and transaction of silver and gold, he highlighted the need to implement risk-based monitoring and regulation system.

He suggested that a special emphasis should be laid on legal reforms and updating the legislations, enhancing efforts among the investigation agencies, expanding international coordination, development of integrated information partnership system and monitoring of digital economy.

Furthermore, he viewed that special attention is paid on minimizing crimes through modern technology and controlling cyber crimes.