For countries like Nepal, facing slow growth as banks deny loans to MSMEs despite surplus capital, Open Banking technology could be a boon.

KATHMANDU: For the past year, the demand for credit in Nepal’s banking system has not grown as expected. According to Nepal Rastra Bank statistics, the loan growth rate of commercial banks this year is slower compared to the previous year.

On the other hand, entrepreneurs and businesses belonging to the Micro, Small, and Medium Enterprises (MSME) sector in the market are always struggling to get easy loans for starting new businesses and expanding old ones. This contradictory situation reveals a deep structural problem in Nepal’s financial system.

The Dichotomy of Credit Demand

According to the trend of the banking sector in the last few years, there are two main reasons why the overall demand for credit has not increased.

First, economic slowdown and uncertainty in the investment environment. Second, the tendency of banks to give more priority to safe and large customers.

Currently, the flow of credit, which is focused on large business groups and contract-related projects, has not expanded as before, while small business owners still face challenges in getting loans approved by banks.

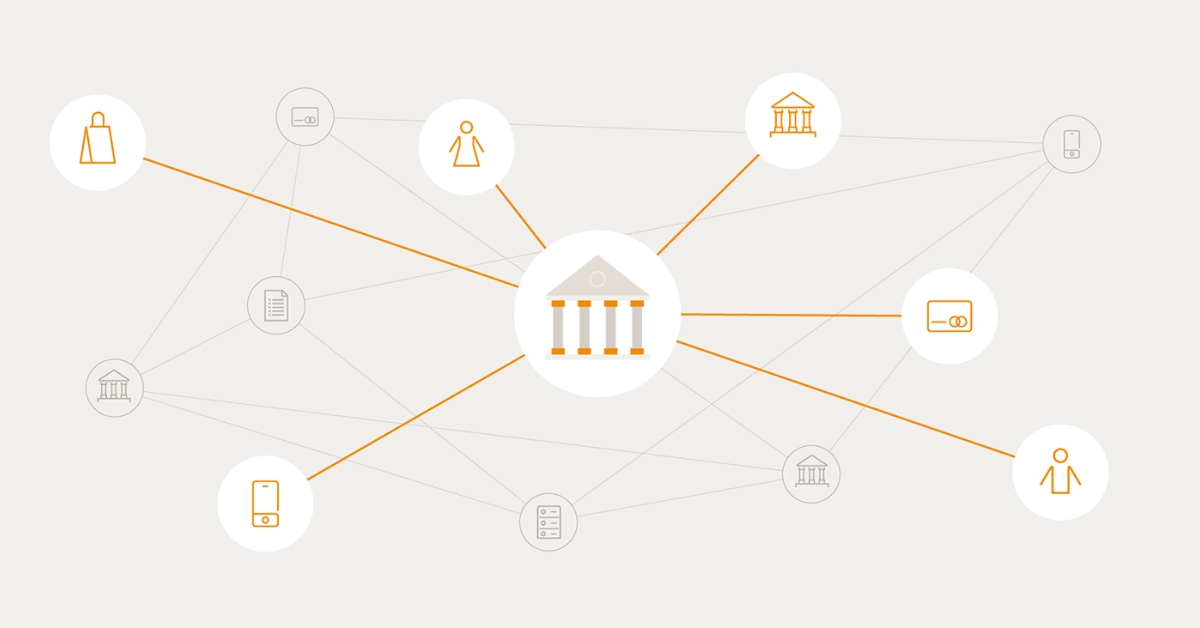

Open banking, as a system that provides consumers and businesses access to various financial services in a safe and regulated environment globally, has brought a new turn to the world economy.

In some cases, small businesses face difficulty accessing banking services even for running their daily operations. Most banks require immovable property, such as land or a house, as collateral for loan approval. The lack of such property among women, youth, and rural entrepreneurs, or banks’ unwillingness to accept it as collateral, excludes them from formal financial access.

Consequently, they are forced into informal channels for loans, approaching local moneylenders, cooperative societies, or microfinance institutions. While such informal loans are obtained quickly and hassle-free, their interest rates are very high, and other forms of exploitation also occur.

The MSME Contribution and Credit Gap

According to estimated figures, small and medium enterprises in Nepal account for about 80 percent of the total Gross Domestic Product (GDP) and 70 percent of employment.

An International Finance Corporation (IFC) study shows that about 40 percent of businesses in this sector in the global economy are outside of easy financial access, meaning they do not receive loans through formal channels. This is negatively affecting production, employment, and inclusive local economic development.

While small and medium-sized enterprises face the problem of not easily getting loans, the banking and financial sector has accumulated liquidity, meaning investment capital.

The slowdown in credit expansion, due to an increase in deposit collection but no visible new investment opportunities, has resulted in sufficient liquidity.

The strategy of banks seeking to limit themselves to large and established customers for low risk ensures financial stability in the short term but hinders long-term economic inclusion.

From a financial analysis perspective, Nepal’s credit policy and risk assessment system are still very traditional. Reliance solely on immovable property as collateral, without using modern technology and data-based systems for evaluating the creditworthiness of small businesses in the market, has halted the expansion of small and medium enterprises.

To expand credit access for small business owners, the monetary regulatory system of Nepal Rastra Bank should be adopted in a smart and flexible manner. By balancing interest rates, utilizing alternative collateral (such as transaction history or tax statements), and initiating open banking or digital credit scoring systems, credit flow can be made more inclusive.

Open Banking as a Solution

The current situation indicates that merely having sufficient liquidity in the financial system is not important; economic growth is not possible if that liquidity cannot be channeled into productive sectors.

Until improvements are made to provide easy access to loans for small and medium-sized enterprises, Nepal’s financial system cannot contribute as expected to move the real economy forward at the desired pace.

Open banking, as a system that provides consumers and businesses access to various financial services in a safe and regulated environment globally, has brought a new turn to the world economy.

If Nepal can adopt this model, it could reduce the long-term financial access gap faced by MSMEs and add new energy to the promotion of entrepreneurship in the country.

Nepal’s financial system is still traditional. Since immovable property like houses and land is required to take a loan, many women and youth entrepreneurs are unable to get loans. Open banking can change this situation.

In most countries of the world, domestic, small, and medium enterprises are the backbone of the internal economy. This is also true in the context of Nepal. Those who run such enterprises are always deprived of easy loan facilities.

They hesitate to take loans from the formal banking system due to a lack of collateral acceptable to the bank, difficulty in proving their creditworthiness, and the high amount banks charge for giving small loans. Nepal is no exception to this.

Assuming that about 40 percent of small and medium enterprises in developing economies do not receive loans from the formal financial system, according to the IFC study, thousands of businesses in Nepal are limited to less than their capacity in production due to an inability to mobilize credit.

Many entrepreneurs in Pokhara, Biratnagar, or Nepalgunj are forced to raise capital through personal savings, informal loans, or microfinance institutions with high-interest rates. This is why the rate of startup closure in Nepal is much higher compared to other countries. This situation is an obstacle to Nepal’s goal of becoming a middle-income country by 2030.

The Importance of Open Banking in Nepal

G-20 nations worldwide have placed the financial access of domestic, small, and medium enterprises at the center of economic reform. India’s Account Aggregator (AA) system, which started in 2021, is a good example of this.

It allows lenders to securely access financial statements (such as banking transactions, tax details) and cash flow of individual or business accounts. This is what is called ‘Open Banking’.

The results in India are encouraging. Within two years of the AA system’s launch, more than two billion accounts have been linked, and consent to access more than 140 million data points has been registered.

This has provided domestic, small, and medium enterprises with quick loan approval, less paperwork, and loans at competitive interest rates. A similar model in Brazil has also brought significant improvement in financial access for small enterprises.

Nepal’s financial system is still traditional. Since immovable property like houses and land is required to take a loan, many women and youth entrepreneurs are unable to get loans.

Open banking can change this situation. By allowing businesses to grant access to their digital records of transactions, tax details, e-commerce sales data and records, or digital payment history through a secure digital system, it will be easier for banks to assess risk. This will help reduce interest rates on small loans and improve the liquidity management of the banking system.

For example, an artisan exporter in Lalitpur can apply for a loan by showing digital records of transactions made through Daraz or other online systems. Similarly, a farmer in Chitwan can take a loan using details of payments received through digital means without collateralizing land.

Digital Preparedness and Challenges

The digital financial system is expanding in Nepal. The use of mobile wallets like eSewa and Khalti, the National Payment Switch, and QR payments are increasing digital ease. The National Digital ID and PAN-based tax system are also preparing the infrastructure for open banking.

But there are also challenges on the journey to open banking. Specifically, financial and digital literacy is still weak in Nepal. According to the Organization for Economic Co-operation and Development (OECD), only about one-quarter of small business owners worldwide have high financial literacy. This rate might be even lower in Nepal, but no study has been conducted on this.

For a country that wants to move toward inclusive economic growth, open banking can be the link that connects aspirations and achievements.

Another challenge is the lack of regulatory clarity. Such clarity is essential. In India, the clear directives of the Reserve Bank of India and the Electronic Personal Information Protection Act made the Account Aggregator (AA) system, the foundation of open banking, possible. Nepal Rastra Bank should also take similar steps and develop the framework for open banking in a phased manner.

Risks and Security Measures

Open banking brings opportunities as well as risks. Misuse of personal information, privacy violations, and cyber security problems can be serious. Therefore, Nepal must build a strong security structure that ensures no one can access personal data without the user’s permission, that consent can be withdrawn at any time, and that regulatory monitoring is strengthened.

A Tool for Economic Transformation

Open banking is not just technology; it is a medium for economic transformation. In India, it has started replacing physical property collateral with ‘information collateral’. The potential for open banking in Nepal is even greater. This is because domestic, small, and medium enterprises account for about 80 percent of GDP and 70 percent of employment.

This system can bring about changes in Nepal such as reducing the cost of loans for small businesses, improving service quality by increasing competition, empowering women, youth, and rural entrepreneurs in formal finance, and reducing dependence on informal debt.

At a time when the G-20 and global financial institutions are emphasizing the spread of open banking, it is now necessary for Nepal to make a decision. If proper policies, investment in digital infrastructure, and building public trust are implemented, Nepal can bring about a revolutionary change in financial access.

For a country that wants to move toward inclusive economic growth, open banking can be the link that connects aspirations and achievements.